When Was Gst Implemented In Malaysia

May 06 2020 The countries in the table below implemented or plan to implement tax relief for businesses and households affected by this health crisis. 69 422 The implementation of GST will result in the products and services to be more expensive.

1

3E Accounting Malaysia is offering affordable pricing for company incorporation and formation services in Selangor Kuala Lumpur Malaysia.

When was gst implemented in malaysia. A hidden Manufacturers Sales Tax was replaced by GST in Canada in the year 1991. 71 424 The Goods and Service Tax system is a way for the government to collect revenue to. Governed by the Sales Tax Act 2018 and the Service Tax Act 2018 the Sales Tax was a federal consumption tax imposed on a wide variety of goods while the Service Tax was levied on customers who consumed certain taxable services.

If you are a GST registered business you need to provide GST-complaint invoices to your clients for sale of good andor services. Apr 18 2018 Table No. GST rates for goods and services have been changed a few time since the new tax regime was implemented in July 2017.

While some products can be purchased without any GST there are others that come at 5 GST 12 GST 18 GST and 28 GST. 26 October 2018 Lower De Minimis Exemption Limit on Inbound Shipments to Indonesia. CONTACT INFO Unit No.

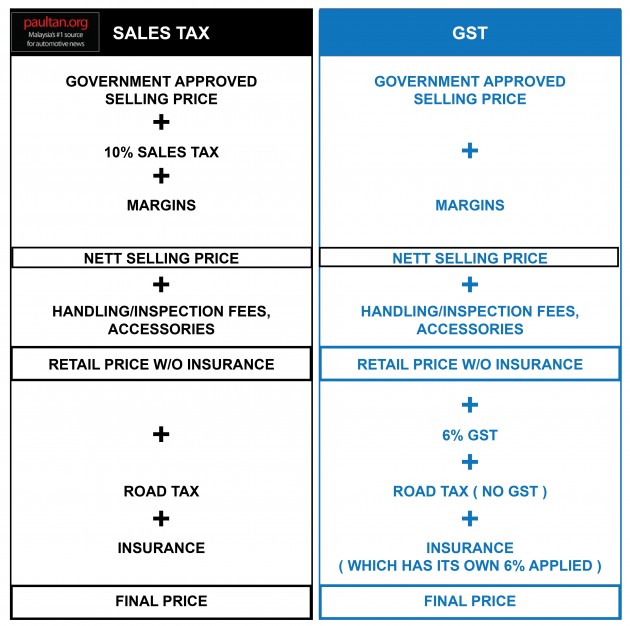

GST was implemented in New Zealand in 1986. Needs an update now to make it relevant for today as GST was implemented. Sales and service tax SST has been doing well in Malaysia before it was replaced a few years backIt stands for 10 percent for sales tax while service tax will be charged 6 percent according to the new release from the finance ministry.

70 423 The newly Implemented GST confused the customers. GST on Imported Low-Value Goods to New Zealand and Changes to Import Documentation. Dravida Munnetra Kazhagam DMK.

May 07 2021 You can create GST compliant invoices FREE of cost using ClearTax BillBook Software. India introduced GST in July 2017 It took almost 17 years to introduce GST in India but at last it was launched. 421 GST is a good method to replace the sales and service tax.

You can create 100 GST complaint bills or bulk import sales and purchase data from your accounting software such as Tally in excel format. The GST was implemented on 1 April 2015. Dravidian Progressive Federation is a political party in India particularly in the state of Tamil Nadu and the union territory of Puducherry.

A very useful course on the indirect tax system that existed till June 2017 the impact of the proposed GST system preparedness of States with emphasis on Karnataka and challenges involved. 20-01 20-02 20-03 Level 20 Menara Centara. The NCT covers an area of 1484 square.

Amongst the various updates from the earlier edition the 2019 guide covers the GST regime in India which came into effect from 1 July 2017 to replace a number of other indirect taxes and the Sales and Service Tax regime implemented in Malaysia from 1 September 2018 which replaced the GST. GST is a value-added tax in Malaysia that came into effect in 2015. Who should issue GST Invoice.

History of GST in India. ClearTax GST with its powerful billing vendor data mismatch reconciliation mechanism validation engines and return filing process serves as a single platform for all GST compliance. This new system has already become operational and it was to be in September 2018 which is a few months back.

GST Tax Goods and Services Tax. DMK is a Dravidian party adhering to the social-democratic and social justice. The income from the newly implemented GST managed to supplant Malaysias national budget from the deficit induced by a loss in oil tax revenue.

A similar provision was prevalent in GST of countries like Australia and Malaysia where it was implemented in a more structured manner with the prescription of a definite formula-based methodology for computing profiteering. ˈ d ɛ l i. Malaysia extended the due dates for making installments of tax due on April 15 for one more month to May 31.

It is probably the biggest tax reform since 1947 when India become gained independence from British Empire. ˈdɛɦliː Dhlī officially the National Capital Territory NCT of Delhi is a city and a union territory of India containing New Delhi the capital of India. Your GST registered vendors will provide GST-compliant purchase invoices to you.

A goods and services tax in Malaysia GST a value added tax was scheduled to be implemented by the government during the third quarter of 2011 but the implementation was delayed until 1 April 2015. Goods and Services Tax GST in Australia is a value added tax of 10 on most goods and services sales with some exemptions such as for certain food healthcare and housing items and concessions including qualifying long term accommodation which is taxed at an effective rate of 55GST is levied on most transactions in the production process but is in many cases. A summary of the principle countries which levy VAT or GST on e-services on non-resident providers selling to consumers.

SST has been implemented in Malaysia replacing the existing Goods and Services Tax GST. In Singapore GST was implemented in 1994. Oil industries considering it a crisis.

Apr 26 2021 Interestingly India is not the first country to witness an anti-profiteering mandate. Countries across the world are extending Value Added Tax VAT and Goods and Services Tax GST indirect taxes to the sale of electronicdigital services by online providersplatforms to consumers. It is currently the ruling party in Tamil Nadu and is part of the Indian political front the United Progressive Alliance UPA.

Details of Tables Page No. Case-by-case deferrals for GST. It is bordered by the state of Haryana on three sides and by Uttar Pradesh to the east.

Apr 01 2010 In Australia the system was introduced in 2000 to replace the Federal Wholesale Tax. By June 2015 worldwide crude oil prices fell to half its value with several nations. Its purpose is to replace the sales and service tax which has been used in the country for several decades.

Sep 01 2018 Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax.

Introduction Of Goods And Services Tax Gst In Malaysia Henry Goh Malaysia Brunei Patent Trade Mark And Industrial Design Agents

Malaysia To Scrap Gst From June 1 Even As India Gung Ho On Its Biggest Tax Reform The Financial Express

The Acceptance Level On Gst Implementation In Malaysia Semantic Scholar

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

The Impacts Of Goods And Services Tax Gst On Middle

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Pengalaman Hidup The Impact Of Malaysia S Gst Implementation Comparing With Singapore

Gst And Its Impact On Malaysia S Automotive Industry

Pdf Goods And Services Tax Gst A New Tax Reform In Malaysia

Post Implementation Of Goods And Services Tax Gst In Malaysia Tax Agents Perceptions On Clients Compliance Behaviour And Tax Agents Roles In Promoting Compliance Topic Of Research Paper In Economics And

You have just read the article entitled When Was Gst Implemented In Malaysia. You can also bookmark this page with the URL : https://englshnit.blogspot.com/2021/12/when-was-gst-implemented-in-malaysia.html

0 Response to "When Was Gst Implemented In Malaysia"

Post a Comment